In Pakistan, white-collar crimes committed by those with money, power, and political connections seldom get punished. And this has been happening even before the Shehbaz Sharif-led government diluted the country’s accountability law in June 2022, benefitting 90 percent of the accused named in massive corruption cases by the National Accountability Bureau (NAB).

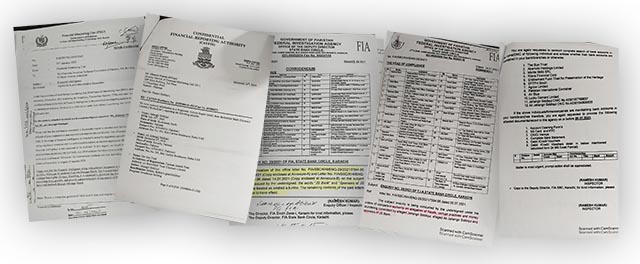

Yes, on August 13, 2021, the Federal Investigation Agency (FIA) — which along with the NAB is also an ace anti-corruption watchdog of the country — removed the names of JS Bank and its sponsors from an inquiry being conducted against them on the allegations of “fraud, corrupt practices and money laundering.”

An FIA letter, dated July 06, 2021, — a copy of which is available with “Narratives” – had named JS Bank, Jahangir Siddiqui Company Ltd., Jahangir Siddiqui, Ali Jahangir Siddiqui and others, in the inquiry. The letter asked the country’s top banks “to conduct a complete search of bank accounts in the name” of 12 companies and individuals. These included, The Sun Trust, Akamoto Holdings Ltd, the Monte Bello SRL, the Rilera Financial Corp, the Endowment Fund Trust for Preservation of the Heritage, the Agrow Limited, and Jahangir Siddiqui and Ali Jahangir Siddiqui. On July 14, 2021, the FIA issued a reminder to all the banks seeking information about the accounts of all the 12 companies and individuals named in the letter.

But barely a month later, on Aug. 13, 2021, the FIA’s State Bank Circle, Karachi, “omitted” the names of the JS Bank and its sponsors from the inquiry. Soon after, the two main FIA officials working on this case — Investigative Officer Ramesh Kumar and Bilal Aslam Khan – were transferred to Gilgit and Quetta respectively.

An FIA official, privy to the way the inquiry was dropped against this powerful business group, said that the Siddiquis’ connections within the former PTI government and the institutions helped them get off the hook. “Although loads of information was available with the FIA, our top tier leadership asked us to remove their names from the inquiry.”

The FIA inquiry was launched following the Confidential Financial Reporting Authority (CAYFIN) of the Cayman Islands named Ali Jahangir Siddiqui and his father, Jahangir Siddiqui, for “suspicious” money transfers. In a letter dated December 16, 2019 (a copy of which is also available with ‘Narratives’), CAYFIN shared details of several suspicious transactions made by the Siddiquis and their companies with the Director General of Pakistan’s Financial Monitoring Unit (FMU), which operates under the umbrella of the Finance Ministry. The CAYFIN letter, giving an overview of the case, said that this business family established ‘The SUN Trust’ and the Akamoto Holdings Limited in October 2011. “The (SUN) Trust was to be ‘settled’ by Jahangir Siddiqui for the benefit of himself and his son, Ali Jahangir Siddiqui (100 percent).”

Their Accounts were opened with the Deutsche Bank Cayman Island Branch in 2011. However, Deutsche Bank sold its global operations to Butterfield Bank (Cayman) Limited, which scrutinized all accounts. During the scrutiny, the Butterfield Bank found irregularities in accounts held by this Pakistani business family and alerted the CAYFIN about the dubious transactions in its Suspicious Activity Report.

The FMU forwarded all this information to the Chairman Securities and Exchange Commission of Pakistan (SECP) on January 31, 2020 in a confidential letter, saying that it had received intelligence from CAYFIN – the Financial Intelligence Unit of Cayman Island – on the accounts of ‘The Sun Trust’ and Akamoto Holdings Ltd maintained at Butterfield Bank, Cayman Island. “The settler and beneficiary of ‘The Sun Trust’ is Mr. Jahangir Siddiqui, however, his grandchildren are also the beneficiaries of this trust.”

Earlier, Tariq Bakhtawar, a SECP director, was suddenly removed from the organization after he tried to take up the same matter referred by CAYFIN just as the two FIA officials probing the damaging allegations against the Siddiquis and their business ventures got transferred.

And this happened despite the fact that CAYFIN provided loads of information about the dubious transactions and money trail of the Siddiquis and their offshore businesses. According to the information, the Trust was under Ali Jehangir Siddiqui’s control till 2017. However, the same year, he was excluded and the three grandchildren of Jahangir Siddiqui were added as beneficiaries. The shareholding of Akamoto Holdings is with The Sun Trust. The reason for the exclusion of Ali Jahangir Siddiqui from ‘The Sun Trust’ on July 7, 2017 was that he planned to enter public life and hold public office. Therefore, his father appointed the three grandchildren aged between one- to two-year-old as beneficiaries.

In August 2017, Ali Jahangir Siddiqui joined the Pakistan Muslim League-Nawaz (PML-N) government and served as a Special Assistant to the Prime Minister with the status of a Minister of State. A few months later, in March 2018, he was appointed Pakistan’s ambassador to the United States by then premier Shahid Khaqan Abbasi amidst concerns within the foreign office as well as sensitive institutions, including the top brass of Pakistan Army, over his inexperience and ability to hold this high-profile and sensitive position. Later, Ali Jahangir Siddiqui maneuvered effectively to become honorary ambassador-at-large under the Pakistan Tehreek-e-Insaaf (PTI) government as well as to cultivate contacts in the country’s mighty security establishment during the period of former Army Chief General Qamar Javed Bajwa. The journey from being a close confidant of Shahid Khaqan Abbasi to holding office in Prime Minister Imran Khan’s camp is an astonishing story of political and business wheeling and dealing, which stunned many people even in the PTI camp.

The CAYFIN letter showed that in December 2011, the Akamoto Company received an amount of US$1.2m from an account with Goldman Sachs, Zurich in the name of the Rilera Financial Corp. “These are the only assets of value to have been injected into the Trust, and a balance of approximately the same amount remains in cash in the Company as of date of filing this… Rilera was noted at the time of inception as being from the ‘settler’s’ family foundation,” the letter read.

According to the letter, Jahangir Siddiqui refused to divulge information to the Deutsche Bank about details of his foundation, citing confidentiality with Goldman Sachs. This refusal raised a red flag among the Deutsche Bank officials, who marked Siddiqui and his associated accounts for strict monitoring. Ali Jahangir Siddiqui controlled the family foundation at that time. “Notes on file suggest that the client was informed that no further amounts could be injected into the structure in this way in future as it was anticipated between US$5-10m could be put into the trust,” the CAYFIN letter said.

The FMU letter to SECP listed details of at least 10 suspicious transactions done by Ali Jahangir Siddiqui. Separate transactions of Endowment Fund Trust for the Preservation of Heritage, Pakistan International Containers and other entities were also mentioned in the FMU letter.

The FMU while recommending further probe into the matter said that Siddiquis “are under investigation of NAB regarding embezzlement, insider trading and stock manipulation, corruption, therefore the information received from CAYFIN” is being shared for further probe.

The Cayman Island authorities said that from 2013-18 “numerous investigations have been launched in Pakistan in relation to our client Jahangir Siddiqui, his financial services business and more recently Ali Jahangir Siddiqui in relation to embezzlement, insider trading, stock manipulation and money laundering.” According to the Butterfield Bank Suspicious Activity Report these accusations related to activities as far back as 2007.

The CAYFIN letter stated that Jahangir Siddiqui and Ali Jahangir Siddiqui “may be engaged in money laundering and that the funds received into the Trust structure, in whole or in part, directly or indirectly relate to the proceeds of crime.” CAYFIN launched thorough investigations into the business interests of the Siddiqui family and their companies. Although no further records were available with Cayman Island authorities on the Siddiqui family and their companies, open source searches did give a glimpse of their shady past, according to the document.

The CAYFIN investigations and the letter gives details of how Ali Jahangir Siddiqi was summoned by the NAB in a case in which he was accused of siphoning off funds amounting to 23.758 million euros in 2008 for the purchase of an Italian company, Monte Bello SLR. Ali Jahangir Siddiqui was the director of investment firm Azgard Nine Ltd at that time and he allegedly used a foreign company, Fairytal SRL, Sweden for this purpose. The NAB said that Fairtal SRL, which was used for the deal, suffered losses along with its shareholders because of the murky transaction.

Investigations also highlighted the case of Agritech Limited. Shares of this company were sold to various financial and government institutions at a price higher than the market rate to settle loan defaults, causing them a huge loss of Rs.40 billion.

Similarly, the SECP in its 2016 report revealed that prices of Azgard Nine group’s shares were artificially increased to Rs.70 from Rs.24, and payments were also made to an unidentified party. However, none of these cases were brought to a closure because of the political and financial clout of Jahangir Siddiqui and his family. Both NAB and the SECP failed to follow through on these cases as well as the FIA.

The CAYFIN letter disclosed that bank status of Akamoto Holding showed that out of the initial deposit of US$1.2 million from Rilera Financial Corp, Goldman Sachs Bank AG Zurich on Dec 1, 2011, US $950,000 was held in cash position, while US$250,000 was invested in the money markets. The Akamoto Holdings Bond portfolio as on Dec. 31, 2018 consisted of $5,218,964 with the USD Market Value of $5,407,470.98. “Akamoto Holdings seems to be taking short term loans against these bonds to execute a variation of investments,” the CAYFIN letter said.

“We are of the view that there are reasonable grounds to suspect that the funds held by the Cayman trust and underlying BVI (British Virgin Islands) company might be derived from proceeds of criminal conduct,” it said, asking Pakistani authorities to contact them for further information. “This information has also been disclosed to the Financial Crime Investigation Unit of the Royal Cayman Island Police Service for intelligence purpose only,” the six-page letter said.

The CAYFIN informed Pakistani authorities that it holds numerous documents provided by the Butterfield Bank on this business family and it should not hesitate to contact it for their copies.

Sadly, the matter remains gathering the proverbial dust on the file FMU offices. And just as the NAB and SECP failed to actively move against this politically connected business family, the Finance Ministry’s Financial Monitoring Unit also seems to be following suit.

With the PML-N government back in power following the ouster of the Imran Khan government in April 2022, the JS Group and its sponsors are breathing easy as fighting and eradicating corruption is no longer a priority of the government and the state institutions. Even the very laws that were aimed to help beat the white collar crime have been diluted to an extent that it is impossible to catch a big money launderer, investigators say.